Fewer animals on the hook, costs and regulation are increasing, meat consumption per capita is stable

The German meat industry has to assert itself in a permanently difficult environment. The reasons for the difficult situation are reductions in pig and cattle numbers caused by political uncertainty and regulatory pressure, and ongoing restrictions on important export markets. The lower volume of animals for slaughter has triggered high pressure for consolidation in the slaughter industry and led to plant closures and sales.

The downstream processing industry, which is also predominantly medium-sized, also suffers from the economic burdens caused by, among other things, high energy and raw material prices and rising wages coupled with a simultaneous labor shortage. The massive cost increases are making it almost impossible for companies to offer their products at reasonable prices. The high inflation of the past few years, especially for food, has clearly felt and unsettled consumers when shopping. Accordingly, price again played a greater role in the purchasing decision.

Slaughterhouses and processing companies are very concerned about the possible consequences of the various legal regulations that have already been implemented in Germany or whose introduction is being discussed. National solo efforts put a strain on the competitiveness of domestic production and make access to the European internal market, which is of great importance for companies and employees in the sector, more difficult.

The associations are also critical of the ongoing discussion about the increase in the price of animal foods through a levy. Neither an animal welfare cent nor the income from an increase in the VAT rate on animal foods can be earmarked. Without long-term contracts between the state and producers that ensure that the funds go directly to the farmers, such a levy would only serve to direct consumption and further reduce animal husbandry in Germany. In addition, through the private sector initiative Animal Welfare, consumers are already able to opt for higher levels of animal husbandry and thus support the transformation towards greater animal welfare.

In addition to the criticism, there are also some positive elements: the inflation rate overall and for food in particular is falling again. For the first time at the beginning of 2024, food prices were found to have fallen compared to the previous year. This increases consumers' willingness to spend and leads to a stabilization of meat consumption. This fell by just 430 grams last year. Unlike the Federal Ministry of Agriculture and Food, the associations do not attribute this to a move away from animal foods, but rather to the previous inflation-related price increases. The efforts of the Federal Ministry of Agriculture and Food to reopen markets that were closed due to African swine fever also had a positive effect.

The offer

In 2023, meat production in Germany fell by 2022 t to 280.000 million t slaughter weight compared to 6,8. This means that meat production has declined for the seventh year in a row and fell again sharply at 4,0%. The decline mainly affected pork and beef.

The commercial slaughter of Pigs continued in 2023 compared to the previous year and again fell extremely sharply by 7,0% (-3,3 million animals) to 43,8 million head. The decline was solely due to the lower number of domestic animals (-7,7% to 42,3 million animals). As in the previous year, the number of slaughters of foreign pigs increased again, this time by 19,5% to around 1,5 million animals. Compared to 2022, pork production fell by 6,8% (307.000 t SG) to 4,180 million t. The downward trend continued unchanged at the beginning of 2024.

The number of commercial slaughtered Cattle decreased in 2023 compared to the previous year only a slight increase of 0,3% to 2,99 million animals. Due to the increased average weight, the slaughter weight increased by 0,987% from 0,6 million t to 0,993 million t. The decline in slaughter affected bulls, cows and calves. However, the number of heifers slaughtered and the number of oxen and young cattle, which are of little importance, rose slightly. The number of bulls slaughtered was still 1,114 million (minus 4.286) and the slaughter weight was 451.000 t (minus 83 t). The number of cows slaughtered fell by 2.100 to 1,006 million. The amount of meat, however, rose slightly by almost 2.100 t to 317.000 t. The number of heifers slaughtered increased by 2.100 to 527.000 and the amount of meat increased by 2.100 t to 165.000 t.

Also in the field of Sheep there was a decline. The number of battles amounted to: 1,073 million units, 4,6% less than 2022, with a slaughter weight of 21.700 t (-5,5%). In the case of sheep, however, the proportion of slaughterings in the non-commercial sector is not insignificant, so that commercial slaughtering only provides an incomplete picture of this segment.

Production of meat products remains at a high level despite a decline

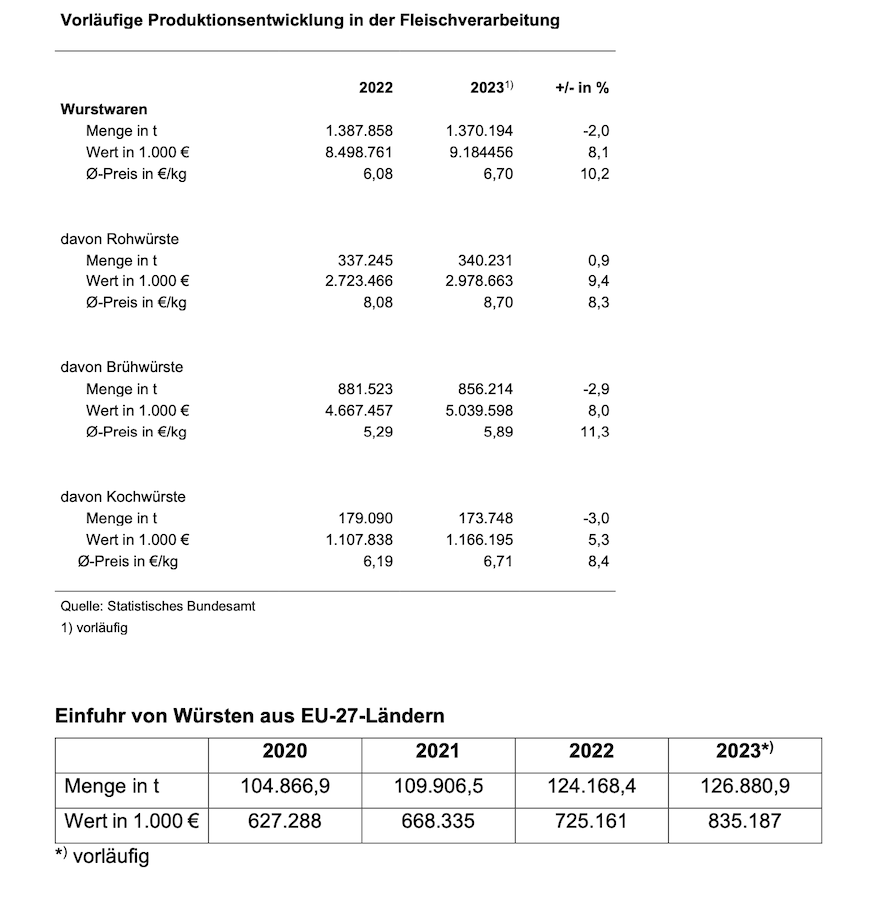

According to preliminary figures, the production volume of meat products fell by an average of 2%, while the average price increased by 10,2%. At the same time, consumer demand for sausage and ham remained stable. This is a clear indication that European competitors are gaining increasing market shares in Germany: imports of sausages from other EU countries into Germany increased significantly from 2020 t to 2023 t between 104.866 and 126.880.

The largest product range last year was boiled sausages with a production volume of 856.214 t (2022: 881.523 t), ahead of raw sausages with 340.231 t (2022: 337.245 t) and cooked sausages with 173.749 t (2022: 179.090 t). Other meat products such as raw or cooked ham are not recorded by official statistics. In addition, companies in the meat industry also produce meat substitute products. However, growth may have lost some momentum, also against the backdrop of inflation. The value of meat substitute products is relatively low compared to meat products. In 2023, the value of meat and meat products produced in Germany was around 43 billion euros - and therefore almost 80 times the value of meat substitute products.

Costs and regulation continue to increase

Parallel to raw material costs, prices are continually rising in almost all areas such as energy, tolls and fuel, which makes the energy-intensive production of sausage and ham products even more expensive. Rising labor costs are putting significant cost pressure on producers. The shortage of skilled workers also represents a serious challenge for the meat industry. In addition, high collective bargaining agreements in the public sector and the railways as well as demands for reduced working hours with full wage compensation are raising expectations that the predominantly medium-sized economy cannot meet.

Due to the increasing regulatory requirements at national and European level, such as the taxonomy and reporting obligations through the Corporate Sustainability Reporting Directive (CSRD) as part of the Green Deal and the Supply Chain Due Diligence Act, companies are exposed to a significant increase in bureaucracy, which affects competitiveness in the international environment significantly reduced. Consumer policy decisions such as husbandry labeling or labeling of origin also mean considerable documentation and control activities not only on the part of state surveillance, but also further significant bureaucratic burdens for companies.

Meat consumption per capita stabilized

Overall, meat consumption in Germany in 2023 fell only slightly by 0,4 kg to 51,6 kg per capita compared to the previous year. The consumption of pork fell to 27,5 kg per capita (-0,6 kg) and beef to 8,9 kg per capita (-0,6 kg). Consumption of poultry meat, however, increased to 13,1 kg/capita (+ 0,9 kg). Consumption remained relatively stable for sheep and goat meat at 0,6 kg and a further 1,4 kg of other types of meat (particularly offal, game, rabbit). The figures mentioned include meat consumption in the form of sausage and ham, which is around 26 kg/capita.

Third country exports declining

German exports of meat and meat products were also severely restricted in 2023 due, among other things, to the occurrence of African swine fever (ASF), although the further spread of the animal disease in Germany could be prevented. Many third countries have maintained import bans on German pork.

With 3,07 million t of meat and meat products exported, the German meat industry recorded a decline in volumes of 2023 t (-418.000%) in 12, a decline for which there is no parallel in recent times. However, export revenue rose by 2,1% to a good €10,5 billion due to the ongoing price increase.

Exports of German sausage products fell to 2023 t in 161.000 (previous year: 165.300 t). Total exports of meat products amounted to 528.900 t, 18.000 t less than in the previous year. Here too, price increases caused export revenues to rise by €166,7 million to €2,909 billion. The most important buyer countries for meat and meat products from Germany are the EU countries, to which 80 to 90% of export volumes flow, depending on the animal species and product category. The export of pork to third countries has only been possible to a very limited extent since the ASF outbreak.

The export of fresh and frozen foods Pork fell by 2023 t to 235.000 million t in 1.235.

Exports to third countries fell by a good fifth year-on-year (-22,5%). In 2022, the decline was significantly higher at -33%. The reason for the slight relaxation was successful negotiations, especially with South Korea, about ASP regionalization and new operating licenses. Exports of by-products also fell sharply, falling by a total of 19,1%. The main reason for this is the ASF-related import ban in many important sales markets (especially in Asia). Demand for these products in the domestic market fell by more than a fifth. The sale of these products on third country markets therefore remains essential.

In domestic trade, German pork exports fell by 2022% to around 15 million t compared to 1,1. The share of third countries in total German pork exports fell from a good 35% in 2020 to 19% in 2021 and further to just 14-15% in 2022 and 2023.

After the sharp decline in the Corona year 2020, exports of fresh and frozen beef recovered somewhat in 2021. A further slight recovery took place in 2022 to a total volume of around 260.100 t. There was a small decline of 2023% in 1,5. The sharp decline in exports to third countries of almost 40% was offset by a slight increase in domestic trade (+2,6%). The share of sales in domestic trade therefore rose by four percentage points to a good 94%. The main target countries outside the EU were Switzerland, Bosnia-Herzegovina, the United Kingdom and Norway. Exports to Norway fell by around 75% compared to the previous year to just 1.876 t. The reason for this is that since August 2022, Norway has no longer granted tariff reductions for beef outside of existing quotas in view of the domestic market situation. Deliveries to Switzerland also fell sharply by 43% to 4.150 t. Exports to the UK also recorded a sharp decline of 57% to around 2.133 tonnes.

The future development of German export performance, due to the high importance of the pork sector, depends on the success of the measures to contain African swine fever (ASF) and, above all, the regionalization negotiations carried out by the Federal Ministry of Food and Agriculture (BMEL). with third countries must be carried out with vigor. Thankfully, initial progress can now be seen here. Exports to South Korea have been possible again since 2023, and the provision of an agreed veterinary certificate for Malaysia is imminent. There are also the first rays of hope with regard to a possible reopening of exports to China.

The meat industry association continues to call for discussions to be opened and continued with the relevant authorities and delegations from third countries in order to achieve further market openings. Export markets remain of vital importance for securing sales for the German meat industry, as added value for essential cuts of meat can only be achieved in third countries.

Overall, imports show no clear trend

Imports of meat products continued to increase in 2023 and rose by around 2022% or 4,6 t to around 18.000 t compared to 398.000, including 127.000 t of sausage products (plus 2.700 t). However, the quantitative import of meat and offal fell in 2023 compared to the previous year by 78.000 t or 3,7% to a total volume of 2,02 million t.

On fresh and frozen Beef In 2023, almost 15% of the total import volume of meat and by-products accounted for. A good 85% of the beef was supplied from other EU countries. A total of around 296.000 t of beef was imported, almost 14% or 78.000 t less than in 2021.

Imports from third countries increased again, but only slightly by 2023% to 3,6 t in 43.800. However, the significant decline in 2020 and 2021 could not be compensated for despite increases in the past two years. In 2019, 56.700 tonnes of fresh and frozen beef were imported from third countries. Price developments in the meat sector in general, but also the continued strong price increases in the catering industry in particular, certainly play an important role in consumer behavior. Chilled beef accounted for 82% of beef imports.

Almost two thirds of German Third country imports was delivered from Argentina (65%). Brazil and Uruguay follow almost on a par with a share of 10% each (4.500 t each). Deliveries from the United Kingdom have increased again. At 1.938 t, this is 4,4% of third country imports, ahead of the USA at 3,0%.

The German Pork imports fell by 2023% to 10,6 t (fresh, chilled and frozen) in 639.985. A good 97% of this amount comes from other EU member states. Because of Brexit, the level of imports from third countries increased slightly compared to the pre-Brexit period, but remained negligible at 14.700 t in 2023. In addition to the UK, Chile, Norway, the USA and Switzerland are possible suppliers of pork to the EU. The majority of sales deliveries (10.000 t) are for sow halves, which do not find enough sales there.